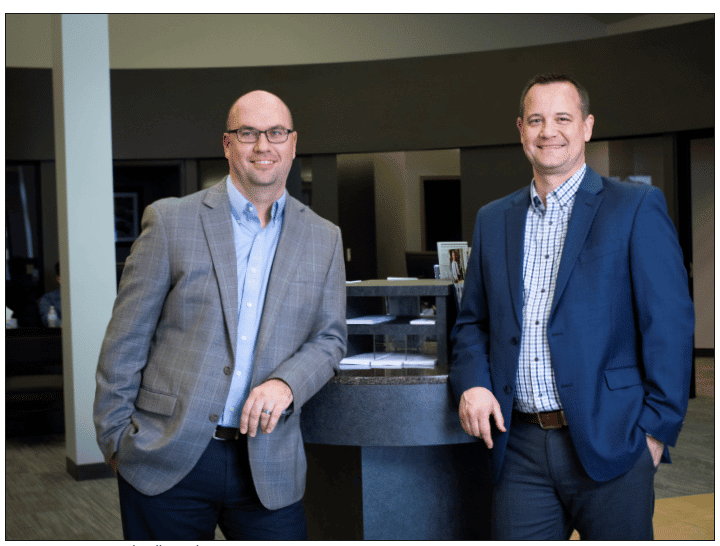

Legacy Bank & Trust appoints Jeff Stutes as Chief Credit Officer

Springfield, Missouri – November 14, 2023 – Legacy Bank & Trust is proud to announce that Jeff Stutes has been appointed as Chief Credit Officer. With many years of banking experience, Stutes brings a wealth of knowledge that will allow for the expansion of Legacy Bank & Trust’s credit department and further strengthen its position in the financial industry.

As Chief Credit Officer, Jeff Stutes will be responsible for credit risk approval and credit oversight for lending business units in all the Bank’s markets, ensuring sound, profitable, and growing credit related portfolios.

Jeff comes to Legacy with 38 years of experience in credit approval, credit underwriting, and loan policy development in various industries and loan types, making him an indispensable addition to the organization. Stutes has experience working in community, regional, and large financial institution credit risk management structures. He also has five years of regulatory experience with the Federal Deposit Insurance Corporation’s Division of Liquidation. With a varied background in the banking industry, Stutes contributes an in-depth perspective that will provide significant value as Legacy embraces the market and regulatory challenges and opportunities over the next decade and beyond.

“We are thrilled to have Jeff leading our efforts to improve our underwriting and credit decision-making, as well as helping us build our team in Dallas,” said Brett Magers, President of Legacy Bank and Trust. “Legacy is honored to have a leader with the resume and abilities that Jeff possesses, in addition to his upstanding character. I’m confident that he will continue to lead our credit program with excellence while prioritizing the service to clients that makes Legacy a great bank to work with.”

“What an incredible opportunity to take on this role with a dynamic organization like Legacy Bank & Trust,” said Stutes. “We are very fortunate to have plenty of fertile ground to grow more effective in our lending initiatives, as well as a team dedicated to the service of those we have the privilege of doing business with. I look forward to continuing the work of building on the solid foundation and culture established by this organization over the course of its 116-year history. We will continue to sharpen our strategy and work around being forward-thinking and effective risk managers in an ever-changing industry, while keeping the commitment to continuously be excellent in our methods.”

With this strategic addition to its leadership across the lending department, Legacy Bank and Trust remains committed to its core values of customer satisfaction, innovation, and prudent financial practices. The appointment of Jeff Stutes into this role reflects the Bank’s dedication to excellence in customer service and lending initiatives, as well as the advancement of the mission to provide exceptional banking services to all its clients.

About Legacy Bank and Trust

Legacy is a $1.6 billion community bank founded in 1907 and acquired in 2003 by Ozarks Heritage Financial Group. Legacy Bank and Trust currently operates branches in Missouri, Oklahoma, and Texas.

Since our first bank opened its doors, our vision has been to surpass standards in banking for our customers as well as local businesses, so they can help our communities thrive. Legacy Bank and Trust exists to serve as the financial leader in economic and community development by providing financial products and services to underserved populations within our service areas. As a Community Development Financial Institution, our mission is to provide economic opportunities to underserved communities.

Legacy Bank and Trust is a Missouri-based commercial bank that is led by its Chairman, Chris Harlin, and its CEO, John Everett and President, Brett Magers.

To learn more about Legacy Bank and Trust, visit www.legacybankandtrust.com

For more information regarding this press release please contact:

Brett Magers, President of Legacy Bank and Trust, at bmagers@legacybankandtrust.com or Katrina Sweaney, SVP, Director of Human Resources at ksweaney@legacybankandtrust.com